Gold has reached another all-time high today and as of 10:10 am Pacific time it’s trading at $1,245, a $13 jump from yesterday…the CDNX, which appears to have started another powerful uptrend, is up 17 points to 1630…aggressive accumulation of Gold Bullion Development (GBB, TSX-V) continues…a 400,000 share bid at 36.5 cents just before the opening bell this morning got things moving with GBB…the stock is currently at 41 cents, a 4.5-cent increase on the day…Gold Bullion faces resistance at 42.5 cents but it’s only a matter of time before that wall is crushed…Seafield Resources (SFF, TSX-V) has ended its recent slide, in our view, and is showing clear signs of an imminent major reversal given technical indicators and the reappearance of M Partners and others on the buy side…Seafield is currently up a penny to 19 cents…the stock reached heavily oversold levels recently, during a deep correction, and the possibility of a major move to the upside exists with the company ramping up its exploration efforts in Colombia…it’s also time once again to be accumulating Sidon International (SD, TSX-V) which should be announcing the closing of its private placement very shortly…Sidon is unchanged at 6 cents this morning…

May 12, 2010

Editor’s Note – Site Technical Difficulties Earlier Today

BMR experienced an issue with our host provider this morning where our site was redirected to malware sites. If any users downloaded files from these malware sites, please delete them.

We have corrected this problem with our host provider.

Our regular BMR Morning Market Musings will be posted shortly.

We apologize for any inconvenience.

May 11, 2010

BMR Morning Market Musings…

Gold is enjoying a great day, closing in on a new all-time high…Gold is up $14 an ounce to $1,217 as of 8:45 am Pacific time, just $9 shy of last December’s all-time high…the CDNX is up 8 points to 1599…the senior golds are clearly outperforming the junior speculative golds at the moment, a trend that has really taken hold here in May…we’re not sure exactly what this means but we’re examining some theories…at BMR over the past week we have been working on some fascinating comparitive charts featuring Gold, the TSX Gold Index, and the CDNX going back 10 years…the normal synchronization among the three has suddenly changed with the CDNX falling out of step…this may not mean a whole lot immediately but, given historical patterns, it could be giving us a clue of some major upcoming developments in the markets – perhaps not for three to six months, but something significant appears to be in the works and it may not be positive…we’re keeping a close eye on this to see if the new pattern we’ve identified continues…Gold Bullion Development (GBB, TSX-V) is unchanged at 36 cents this morning…over the last two trading days Jordan Capital has been a very aggressive buyer of GBB which is an encouraging sign as Jordan was first on the scene, so to speak, with GBB last December…Kent Exploration (KEX, TSX-V) is up penny to 18.5 cents…with its upcoming spinoff, Kent offers extraordinary value at current levels but it seems some people aren’t very good at math and haven’t figured it out just yet…or else they think Kent’s doing a rollback and not a spinoff…40,000 shares of Kent at 18.5 cents gives an investor 10,000 shares of Archean Star Resources which is being financed at 25 cents…the argument that Kent’s share price is going to suffer significantly moving forward because of the spin-off of its Gnaweeda Gold Project doesn’t hold water in our view…investors can expect Kent to get much more aggressive with its Alexander River Gold Property and its Flagstaff Barite Property following the spin-off…the high grade barite project has the potential to generate $1.5 million or better in cash flow for Kent this year while Alexander River has an historical (non-compliant) resource estimate of over 600,000 ounces…it has excellent potential to develop into a 1 million-plus ounce deposit…with regard to Archean, it will be developing a highly prospective gold project in partnership with Teck that has multi-million ounce potential…we highlighted Yamana Gold (YRI, TSX) yesterday here at BMR and it appears Yamana is breaking out technically as we anticipated it would…our technical analyst sees Yamana jumping to $13.50 in the near term…YRI is up 65 cents to $11.62 at the moment…Yamana is also doing a joint venture with one of our favorites, Colombian Gold Mines (CMJ, TSX-V)…Colombian is up 12 cents to $1.14…

May 10, 2010

CDNX Update: A Critical Two Weeks Coming Up

The CDNX seems to have curiously disconnected recently from the price of Gold, as we mentioned in our Week In Review, but we’ll need more time to see if this pattern continues and what the significance of it might be.

The Index made a nice move today, however, confirming our analysis that a reversal was likely in the works. John, BMR’s technical analyst, gives us his assessment after today’s impressive 41-point move:

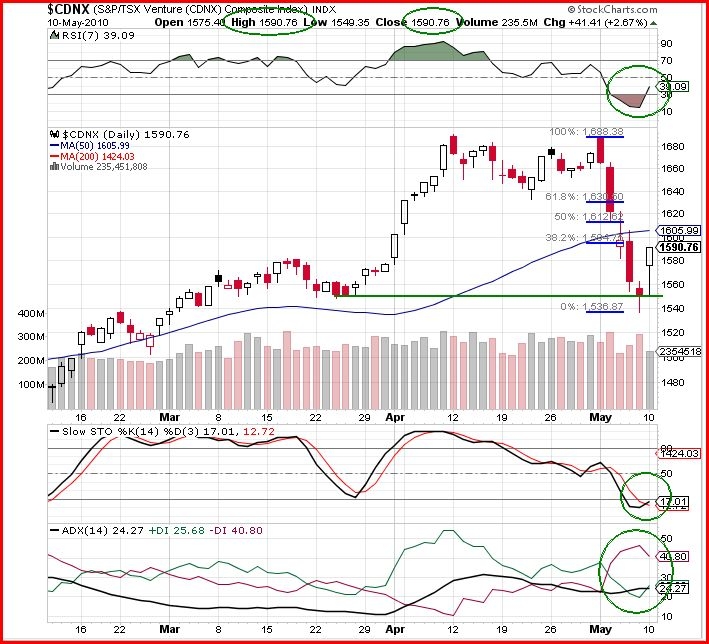

John: Today the CDNX rebounded 2.67% and finished at its high of the day, 1591. The trading pattern of the next few days could provide a good indication of the direction of its next major move.

Looking at the chart we see that the white candle provided confirmation of Friday’s hammer candle to signify a reversal from the five-day plunge of last week. The combination of Thursday’s, Friday’s and today’s candle is called a “morning star” and is recognized as a bullish “reversal candle pattern”.

One of the main reasons for posting this chart is to allow our readers to follow each day’s moves with respect to the Fibonacci retracement levels shown as blue bars.

Today’s candle finished strongly so we can reasonably expect the move up to continue for at least tomorrow morning. Keep an eye on the CDNX level and compare it to the Fib. levels. If the retracement stops at the 38.2% level and reverses, then the retracement (recovery) is weak. If it moves up to the 50% and reverses, then it will probably consolidate. And if it moves up to the 61.8% (resistance level), then it is a strong retracement and probably will move up to its previous high (resistance level).

Having the Fibonacci levels on a chart provides a reliable reference.

What do the indicators tell us?

The RSI, which at the end of last week was deep into the oversold region, has moved up to the 39% level due to the strength of the move today which was very strong.

The Slow Stochastics has the %K (black line) crossing up over the %D (red line) below the 20% level – a very bullish sign.

The ADX trend indicator is showing confusion at this time. The ADX (black line) trend strength is flat because there is no trend. The -DI (red line) has turned down sharply and the +DI (green line) has turned sharply up due to this sudden reversal.

Today, every market in Asia, in Europe and in North America experienced sudden reversals in response to Europe’s attempt to solve the financial problems in Greece and elsewhere in the EU. Today, as it did last week, the CDNX responded to market psychology rather than to Gold or any market sector.

The outlook for the CDNX is bullish for the immediate future but the next two weeks could be critical in determining where its intermediate and long term trend will be.

Yamana Gold: Gearing Up For A Move

12:30 pm 05/10/10:

At BMR we focus primarily on the very speculative junior resource stocks, uncovering home run opportunity gems like Gold Bullion Development (GBB, TSX-V) that have excellent exploration potential and are flying “under the radar”.

Today, however, we’re going to bring to your attention a well known gold producing company that has a very attractive-looking chart – Yamana Gold (YRI, TSX). Yamana is a low-cost intermediate producer and on track to deliver 1.1 million gold equivalent ounces this year (1.5 million by 2012).

It’s clear to us, especially after this morning’s news of the EU-IMF $1 trillion bailout plan for fiscally inept European countries such as Greece, that Gold is on its way to a new all-time high. Concern over sovereign debt issues and the global currency system could easily push Gold to $1,300 or higher in the near future. A money-making company like Yamana with an expected 50% increase in production within the next year-and-a-half is going to perform extremely well in a higher Gold price environment, even if the general stock market runs into trouble (we’re seeing evidence of a de-coupling of the TSX Gold Index from the general market). No doubt there are other producers such as Yamana that should do extremely well but this is definitely a stock worth serious consideration (for what it’s worth, Canaccord has a price target of $17.75). At BMR, we’re fervent believers in the science and value of technical analysis and Yamana’s chart tells us now is the time to get positioned in this stock.

Yamana, which has been trading around the $11 level today, has been fighting a declining 100-day moving average (SMA) since January but it appears that’s about to change. John, BMR’s technical analyst, gives us a more detailed technical overview below:

John: Since the first week of March, Yamana Gold (YRI, TSX) has formed a bullish chart pattern called a “Cup with Handle” and at any time could break out for a significant move up.

Looking at the daily chart, I have drawn in the “cup” in blue lines and the “handle” in sloping black lines. This cup looks very good in that it’s not too deep and it’s “u” shaped. The handle has not declined too far, thus with reasonably high volume it should be able to break up through the top of the cup at $11.45 with a target of $13.50 (top green line) which is also a line of resistance. The target is found by adding the depth of the cup to the level of the top of the cup.

The chart shows good support at the bottom of the cup with a “double bottom” which is a reliable reversal pattern (blue circles).

The handle is a “down sloping flag”, a bullish consolidation pattern, so watch for a move up through the top of the handle as a precursor for the big breakout. The candle at the moment is a doji so there is no pressure up or down.

The 50-day SMA (blue line) is providing strong support for the “handle”, and the 200-day SMA (red line) is at the moment providing resistance at $11.45. Thus a breakout will have both SMA’s supporting the move. Once the breakout occurs, the 200-day SMA will turn from resistance to support.

The RSI is above 50%, thus is bullish and is not threatening to breakdown through the 50% level.

The Full Stochastics – both the %K and the %D are high and are bullish.

The ADX tend indicator has the ADX trend strength line (black) flat and the +DI (green line) is above the -DI (red line) which is a bullish orientation.

Outlook: YRI has declined from a high of $15 in November, 2009, to a recent low of $9.92 and now is poised for a breakout to an initial target of $13.50.

BMR Morning Market Musings…

Markets are up across the board this morning on news that the EU and IMF have agreed on a $1 trillion emergency rescue package to prevent the sovereign debt crisis from spreading…what’s really happening is that borrowed money is being used on top of borrowed money to help bail out fiscally irresponsible countries who got into trouble with borrowed money…the ultimate effect, we believe, is going to be higher gold prices as concern over debt and the global currency system gradually intensifies…Gold is off on some profit-taking this morning but it’s hovering right around the $1,200 level where there should be strong support…the CDNX is ahead 36 points as of 8:25 am Pacific time to 1585…Gold Bullion Development (GBB, TSX-V) appears to be under some technical pressure with a declining 10-day moving average which presents an attractive accumulation opportunity for those who can see the big picture that’s unfolding with GBB…the stock is off 1.5 cents to 34.5 cents…Kent Exploration (KEX, TSX-V) is up 1.5 cents to 19 cents…the Archean Star spin-off is close at hand…it’s interesting to note that Australian-listed Doray Minerals has discovered a second zone of high grade mineralization at its Andy Well Property, just 8 miles northwest of Kent’s Turnberry Prospect which – along with the rest of the Gnaweeda Gold Project – is being vended into Archean Star…Doray Minerals will be starting a second round of drilling this month at Andy Well…initial assay results from Turnberry are expected by month-end…the “effective date” has not yet been announced but Kent shareholders will receive one share of Archean Star for every four shares of Kent they hold…North Arrow Minerals (NAR, TSX-V) is up a penny to 22 cents…North Arrow, which holds a very attractive package of diamond, lithium, base metal and gold properties, has been under increasing accumulation since mid-March…this company is led by mining legend Gren Thomas, and the possibility of North Arrow making a major discovery on any one of its properties is very real…Thomas, who is one of the very best at grass roots exploration, is getting aggressive on the exploration front with North Arrow…he’s a huge shareholder himself in the company and has vowed not to sell a single share until this company is taken over…

May 9, 2010

The Dynamic Diamond Duo Gives North Arrow Massive Potential

BMR Interviews Mining Legend Gren Thomas:

Ground work begins shortly at North Arrow Minerals’ (NAR, TSX-V) huge landholdings at Lac de Gras where new technology is being brought to bear on an area that holds immense potential for another major diamond discovery in the Northwest Territories.

Gren Thomas and Dr. Chris Jennings teamed up two decades ago to discover Diavik, and now the dynamic diamond duo has reunited for an attempt at similar success with North Arrow.

Jennings’ proprietary technology has identified no less than 70 high priority kimberlite targets on North Arrow’s property which is right on trend with Diavik. Only one of those targets has been drilled by previous operators.

At just 21 cents for a market cap of only $8 million, North Arrow’s upside potential is absolutely massive which is the reason we added this company to the BMR Portfolio a month ago. North Arrow also has lithium, base metal and gold projects, but the diamond play at Lac de Gras is what could propel this stock into the stratosphere and make NAR another huge winner for both Thomas and Jennings. These are proven mine finders who are legends in the industry.

If you’re looking for a stock to flip in a day or two, this is not for you. But if you believe that one way to make A LOT of money is to follow those who already have it and have earned it in the way Thomas and Jennings have, by being incredibly successful in the grass roots exploration business, then North Arrow may very well be the right investment for you.

BMR expects big things over the coming weeks and months from North Arrow which has been under steadily increasing accumulation since mid-March. The stock has strong technical support around current levels and a chart that shows it’s likely in the early stages of a powerful upside move.

North Arrow’s Lac de Gras play is an intriguing story, so BMR went right to the top to find out more. Click on the link below to listen to our fascinating discussion with Gren Thomas on diamonds at Lac De Gras.

Yes, diamonds can be an investor’s best friend!

GENIVAR Takes Aim At Uncovering The Potential Riches Of Granada

Gold Bullion Development (GBB, TSX-V) President & CEO Frank Basa is not prone to exaggeration or hype – in fact, most would say he’s quite the opposite – so for him to come up with the name “LONG Bars Zone” (an acronym for “Lots of New Gold Bars“) speaks volumes about his faith in the Granada Gold Property and what his company may uncover there. Gold Bullion actually poured its first gold bar at the Granada Mine in 2006. “Lots of New Gold Bars” is music to investors’ ears with gold currently at $1,200 an ounce and possibly on its way to $1,500 or better.

Gold Bullion has started a 20,000 metre drill program at Granada under the watchful eye of GENIVAR, their geological consultant. GENIVAR put together an extremely efficient and effective Phase 1 program. With a limited Gold Bullion budget they covered a wide area with 2,817 metres of drilling and made a significant discovery in the northeast section of the LONG Bars Zone. This was no easy task. They learned a lot more about the geological plumbing of Granada and the potential this property has. And because of that, as they made it clear to me during my on-site visit in March, they expect this next round of drilling to be even more successful.

Here’s our view of what could happen as a result of Phase 2 (speculation, of course, and we don’t wish to heighten expectations, but this does seem very plausible):

1. The Block Model contains more gold potential than first thought (the current non-compliant estimate is 2.4 to 2.6 million ounces) with new discoveries at depth and along the northern boundary where limited historical drilling has taken place;

2. Outside the Block Model, a new resource takes shape in the northeast area with additional drilling. Step-outs to the east and north also prove successful, confirming historical reports and current theories/observations that mineralization is very widespread and broad based at Granada;

3. Significant new resource potential is confirmed west of the Block Model where historical drilling returned encouraging results;

4. Deep drilling within the Block Model (and perhaps outside the Block Model) reveals that indeed there is more than just gold at Granada. We know that silver was mined from this property in the 1930’s. In addition, silver, copper and nickel credits showed up in Gold Bullion’s 2007 bulk sample and in the only four holes that were tested for non-gold mineralization in Phase 1.

The current Preliminary Block Model encompasses a mineralized area that includes only 55% of the LONG Bars Zone current strike length of 1,100 metres. With the Block Model itself open at depth (can’t wait to see what Gold Bullion finds at depths greater than two or three hundred metres), and significant mineralization discovered east, west and north of the Block Model, it’s very hard to imagine this deposit ultimately proving up to be anything less than five million ounces.

The start of the Phase 2 drill plan seems to be very well thought out. Gold Bullion is drilling west to east along the northern boundary of the Block Model which will lead them to the east-northeast discovery area where a significant number of additional holes will be drilled. From there they will step-out to the north and the east.

The waste pile area in the northwest part of the LONG Bars Zone – just east of Pit #1 and within the Block Model – has been of intense interest for geologists. Gold Bullion’s first three holes in Phase 1 were drilled at the very western edge of the waste pile and two of them came up with interesting results including GR-09-02 which returned 1.74 g/t Au over 32.5 metres (from 15.5 to 48 metres). The first holes of Phase 2 are being drilled at an angle from just north of the waste pile right into the guts of the northerly- dipping Block Model structure which GENIVAR hopes to intersect. This has the potential of delivering some impressive initial results. Multiple known vein structures are going to be tested, and GENIVAR will also get an even better understanding of the location of faults and – importantly – their orientation. GENIVAR knows what’s it’s doing and they are going to succeed. I’m no geologist but I’ve been around the resource business a long time. My head and my gut both tell me GENIVAR’s “genius” is going to nail down a deposit here that’s going to shock a lot of people. These things take time but it will come to fruition.

If geologists like what they see in the early part of Phase 2, expect a second drill rig to arrive on the scene very quickly. The advantage of two rigs is very clear – one can focus on infill and definition drilling within the Block Model while the other can complete exploratory drilling elsewhere. Twenty thousand metres could be completed by the end of July or August. Or perhaps we’ll see more than two drill rigs. Anything’s possible.

Let there be no doubt – as exciting as this play has been since the 1st of March in particular, the real excitement has yet to even begin. It’ll be a summer to remember in the LONG Bars Zone and we’ll be going back there to bring this story home to investors like never before.

BullMarketRun.ca

BullMarketRun.ca