CDNX and Gold

It was an incredible week on the markets with Gold moving above $1,200 again and the Dow plunging nearly 1,000 points intra-day on Thursday. For the week, the CDNX was down 125 points or 7.5% (by comparison, the Dow fell 629 points or 5.7%, the Nasdaq plunged 195 points or 7.9%, while the TSX was off 519 points or 4.3%).

So what are we to make of this? A lot of traders and investors are ducking, running for cover, and selling without thinking twice. From a fundamental perspective, what’s driving the fear and sending Gold higher is uncertainty and concern regarding sovereign debt issues and the global currency system.

Let’s focus on the CDNX which has proven to be such a reliable “leading indicator”. Here are some key points investors have to understand:

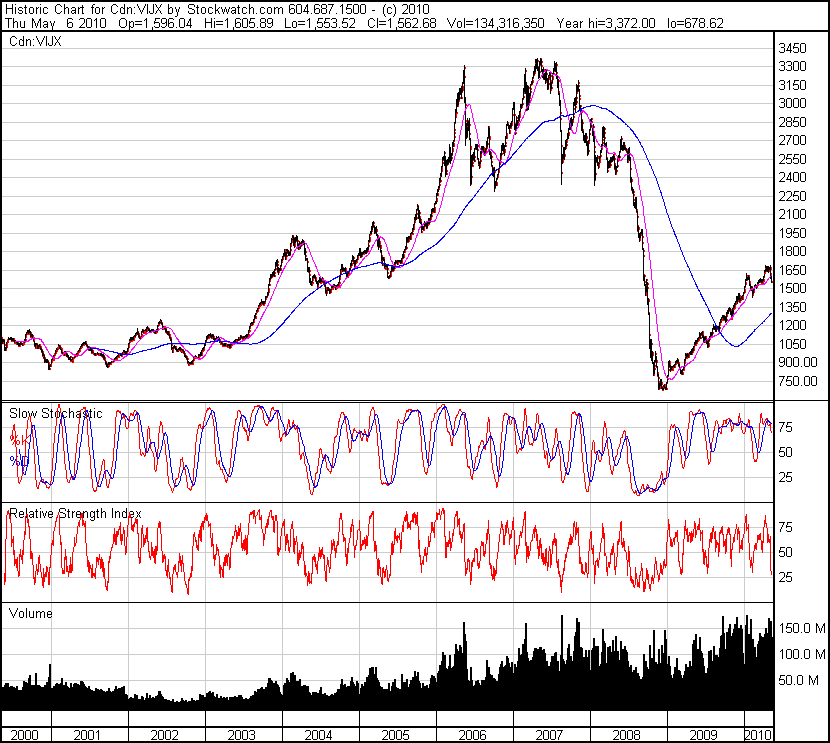

1. The Venture Exchange remains very entrenched in a long-term bull market (rising 200 and 300-day moving averages that are in no danger of reversing) and even a drop to 1200 on the Index won’t change that;

2. We have witnessed a series of higher lows with the CDNX over the course of the past 14 months as follows: 810, 1028, 1264, and 1429. There’s a very good chance the CDNX is putting in another low right now – right around 1500, give or take 1 or 2 per cent. That low may have been reached Friday at 1536 or we could see it very early in the coming week;

3. The CDNX RSI level is at its lowest point since late 2008 – slightly below the levels reached at the major market bottoms identified above (810, 1028, 1264 and 1429) which occured in March, 2009, July, 2009, October, 2009, and February, 2010, respectively. The pattern of a higher low every few months is continuing;

4. While the CDNX has dropped slightly below its 100-day SMA for the first time in over a year, it is currently underpinned by rising 50, 100, 200 and 300-day moving averages as well as an impressive zone of strong overall support ranging from 1480 to 1550;

5. Gold is likely going to break out soon to a new all-time high which has to be positive for the Gold-sensitive CDNX.

On the negative side:

1. The CDNX is clearly overdue for a nasty 20 or 30% correction which historically occurs every year or two within a bull market. Theoretically, we could be in the midst of that now;

2. The drop below the 100-day SMA, for the first time in this new bull market cycle, raises a cautionary flag;

3. The short-term moving averages (10 and 20-day) are falling;

4. The fact the CDNX has been moving in the opposite direction of Gold and the TSX Gold Index recently is cause for some confusion and concern, suggesting that Gold is either headed for a significant drop (seemingly highly unlikely) or, alternatively, stock markets generally could be in for a major correction beyond what we’ve already witnessed. The CDNX significantly outperformed Gold and the TSX Gold Index from December through March, correctly predicting higher Gold prices, so this sudden change raises serious questions. Why has it happened and what does it mean? The senior (producing) Gold companies have de-coupled from the general stock market and are now moving in tandem with Gold. The companies actually producing Gold, right this minute, seem to be more in favor than the ones just looking for it (the Venture plays).

With regard to point #4, however, the CDNX actually slightly outperformed the Dow over the last three trading days which is significant: If the major markets were about to go into free-fall, the CDNX normally would be leading the way – money always comes out of this speculative market first and much more quickly when investors sense a major stock market correction is on the way. The Dow’s plunge Thursday was likely an important bottom.

As you can tell, there are some contradictory signs in the market right now. That’s what makes this business so interesting – it’s like trying to solve a puzzle.

So taking all factors into consideration, here is our conclusion and guidance:

1. The greater probability (75%) is that the CDNX has already bottomed out or is very close to bottoming out around current levels – watch for the possibility of an intra-day plunge that could take the Index slightly below 1500, followed by an immediate and powerful reversal marking the start of a new uptrend;

2. The risk of a 20 to 30% correction right now from the 1691 April high exists (triggered by outside forces) – we would be foolish not to recognize this possibility. However, I am assigning a probability of only 25% to this and if it were to happen, investors would be presented with one of the best buying opportunities of a lifetime.

One cannot go against Gold at the moment, it is looking so powerful. In fact, $1,200 could quite possibly become the new floor. What has been highly significant regarding Gold in recent months is that it’s moving higher even with the U.S. Dollar going higher. This breaks the previous pattern of Gold weakness during U.S. Dollar strength. It appears Gold is going higher now no matter what the U.S. Dollar does. What this all means fundamentally in terms of the global currency and financial system, we’ll have to wait and see. But everyone right now should have exposure to gold in some form, either in quality gold shares and/or gold itself.

BullMarketRun.ca

BullMarketRun.ca